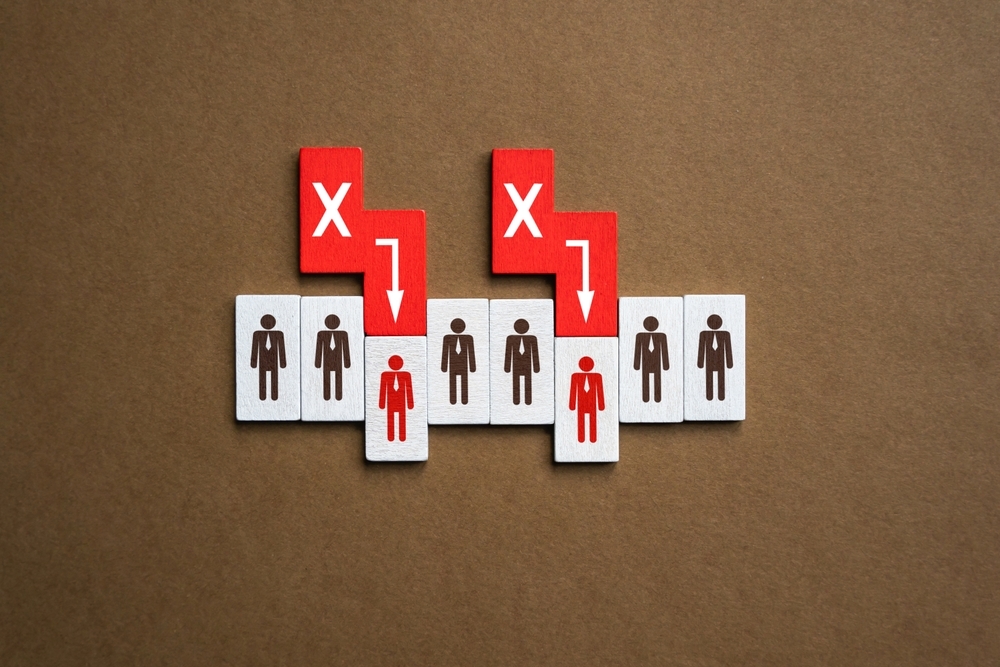

What IRS Downsizing Means for Taxpayers Today

In the wake of large-scale staffing reductions, the Internal Revenue Service (IRS) is undergoing a transformation that is already affecting taxpayers...

3 min read

Wei Wei & Co

:

Sep 12, 2025 11:08:24 AM

The One Big Beautiful Bill Act (OBBBA) brings sweeping changes to how businesses claim deductions for selling goods and services abroad. The well-known foreign-derived intangible income (FDII) deduction has been recast as foreign-derived deduction eligible income (FDDEI), with modifications that broaden access but also adjust the calculation. Most changes apply to tax years beginning after December 31, 2025.

For businesses exporting products or providing services to foreign customers, these updates will have a direct impact on planning and compliance.

Despite the lower deduction rate, many taxpayers—especially those with significant fixed assets, R&E expenses, or interest expense—may find the overall benefit increases. Businesses should begin evaluating planning strategies now to optimize results.

When FDII was enacted in 2017, the QBAI rule reduced eligible deductions by applying a 10% deemed return on tangible property. Under the OBBBA, this reduction disappears, potentially enhancing deductions for capital-intensive industries.

Companies with substantial depreciable assets that previously saw limited FDII benefits may now have expanded opportunities under FDDEI beginning in 2026.

The OBBBA confirms that income from transfers of IP in Section 367(d) transactions, or sales of such property, no longer qualifies for the FDDEI deduction. This applies to transfers occurring after June 16, 2025. Exports of patents, copyrights, and similar proprietary assets therefore lose preferential treatment under the revised rules.

Starting in 2026, taxpayers will no longer need to allocate interest or R&E expenses against FDDEI. Under the prior rules, these allocations significantly reduced—or eliminated—the deduction for companies with high financing or R&E costs.

This change could prove especially beneficial for industries such as private equity, where Section 163(j) limitations restricted deductions, and for businesses now eligible to expense R&E under Section 174A.

Although the FDDEI changes take effect for tax years beginning after 2025, taxpayers should prepare now. Effective planning may include:

Companies may be able to time the recognition of income and expenses to take advantage of whichever regime—FDII or FDDEI—offers greater benefits. In some cases, IRS approval may be required to change accounting methods, which can be obtained through automatic or non-automatic procedures.

The OBBBA introduces Section 174A, permanently restoring full expensing of domestic research costs beginning in 2025. Foreign research must still be amortized over 15 years under Section 174.

Taxpayers may elect to:

Special transition relief applies for certain small businesses under the Section 448 gross receipts test.

Consideration: Accelerating R&E deductions in 2025 or 2026 may reduce taxable income to a point where the Section 250 FDDEI deduction is diminished or lost. Strategic decisions on expensing versus capitalization are critical.

The OBBBA permanently restores 100% bonus depreciation for property placed in service after January 19, 2025.

It also creates a new elective deduction under Section 168(n) for nonresidential real property used in production activities, provided construction begins between January 19, 2025, and January 1, 2029, and is placed in service by the end of 2030.

Consideration: While full expensing lowers current-year taxable income, it may also reduce FDDEI. Taxpayers must weigh immediate savings against longer-term deduction benefits.

With the overhaul of FDII/FDDEI, businesses should revisit global value chains. Decisions on where to locate manufacturing, R&D, and IP ownership can significantly affect outcomes under the new rules. However, transfer pricing, exit tax, and valuation issues must all be carefully considered when restructuring.

The OBBBA significantly reshapes foreign-derived income deductions, creating both risks and opportunities. By modeling scenarios, exploring accounting methods, and reviewing value chains, taxpayers can prepare for the transition and optimize benefits.

At Wei, Wei & Co., LLP, our Tax Services team helps businesses navigate the evolving international tax landscape with strategies tailored to their operations. Contact us today to learn more about how we can serve you.

In the wake of large-scale staffing reductions, the Internal Revenue Service (IRS) is undergoing a transformation that is already affecting taxpayers...

President Donald Trump signed the “One Big Beautiful Bill Act” (OBBBA) into law on July 4, following a 51–50 Senate vote on July 1 and a 218–214...

In 2022, Congress passed the Inflation Reduction Act (IRA), a broad piece of legislation featuring provisions to advance clean energy production and...